News

Junior Achievement of Georgia

Posted by PromiseOne Bank in News

[3/28/2023] PromiseOne Bank team had a great time volunteering with Junior Achievement of Georgia at their Discovery Center in Gwinnett. Our dedicated volunteers assisted Richards Middle school student through the rare opportunity to experience their personal financial futures first-hand. Volunteers assisted students in an immersive simulation that enabled the students to develop skills to successfully navigate todays complex economic environment and discover how decisions today can impact tomorrow. It was fun working with the students and sharing our financial knowledge that the students can utilize as they plan for the future! PromiseOne Bank will be planning future events and will continue support for our community!

The 5th Shredding Event

Posted by PromiseOne Bank in News

PromiseOne Bank had another opportunity to give back to the community with its annual shredding event.

The 5th shredding event took place last Saturday at the Duluth Branch located at 2385 Pleasant Hill Rd., Duluth, from 10 am to 12 pm.

We were delighted to welcome over customers and non-customers to the event.

We were grateful for the opportunity to assist them in safely disposing of their sensitive documents.

PromiseOne Bank had another opportunity to give back to the community with its annual shredding event.

The 5th shredding event took place last Saturday at the Duluth Branch located at 2385 Pleasant Hill Rd., Duluth, from 10 am to 12 pm.

We were delighted to welcome over customers and non-customers to the event.

We were grateful for the opportunity to assist them in safely disposing of their sensitive documents.

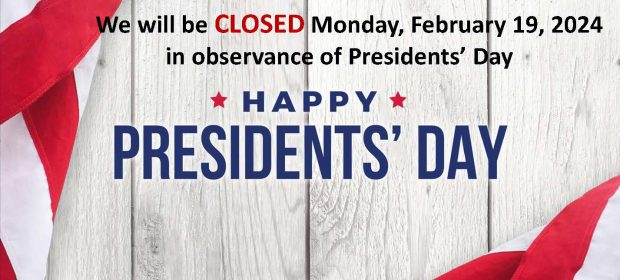

Presidents’ Day 2024

Posted by PromiseOne Bank in News

[02/19/2024]

Please note all PromiseOne Bank branches will be closed on Monday, February 19th, 2024 in observance of Presidents' Day.

[02/19/2024]

Please note all PromiseOne Bank branches will be closed on Monday, February 19th, 2024 in observance of Presidents' Day.

Martin Luther King Jr. Day 2024

Posted by PromiseOne Bank in News

[1/15/2024]

Please note all PromiseOne Bank branches will be closed on Monday, January 15th, 2024 in observance of Martin Luther King Jr. Day.

[1/15/2024]

Please note all PromiseOne Bank branches will be closed on Monday, January 15th, 2024 in observance of Martin Luther King Jr. Day.

Scholarship award ceremony

Posted by PromiseOne Bank in News

[12/01/2022] PromiseOne Bank awarded $20,000 in scholarships to high school and college students in Gwinnett, Fulton, Dekalb, Harris (TX) counties. This is our 8th year hosting this scholarship event and we received the greatest number of applications. We are very excited and proud to continue our annual scholarship program that has helped so many students in our communities and hope to continue supporting students’ goals. Here are the list of this year’s scholarship recipients. Congratulations! Caroline Choi (Peachtree Ridge High School) Injae Cho (Georgia Tech) Jacob Park (Northview High School) Rachel Jeong (University of Texas at Austin) Rachel Park (Georgia Tech) Wonjin Cho (Georgia Tech) Alex Yang (University of Georgia) Lauren Pak (Georgia Tech) Noel Park (Georgia State University) Yeeun Kim (Kennesaw State University)

JA Discovery Center Gwinnett

Posted by PromiseOne Bank in News

[2/13/2023] PromiseOne Bank team had a great time volunteering with Junior Achievement of Georgia at their Discovery Center in Gwinnett. Our dedicated volunteers assisted Jordan Middle school student through the rare opportunity to experience their personal financial futures first-hand. Volunteers assisted students in an immersive simulation that enabled the students to develop skills to successfully navigate todays complex economic environment and discover how decisions today can impact tomorrow. It was fun working with the students and sharing our financial knowledge that the students can utilize as they plan for the future! PromiseOne Bank will be planning future events and will continue support for our community!

2022 PromiseOne Bank Scholarship

Posted by PromiseOne Bank in News

[09/01/2022] The 8th PromiseOne Bank Scholarship with Choson Foundation Look Forward to the Future! To encourage the academic future of students of the community, PromiseOne Bank and Choson Foundation jointly offering scholarship to 10 students.

- Who: High School Senior and College Student of 2022-2023 school year for schools located in Gwinnett, Fulton, DeKalb, Harris (TX) Counties.

- Scholarship Amount: $2,000.00 per person (Total 10 Students)

- Application for Scholarship

- Unofficial Transcript – If the student’s application is selected, we may ask that a sealed official transcript to mailed to us prior to the disbursement of the scholarship award

- 2021 tax return of student’s parent/guardian

- Essay – “What's the most difficult challenge you've ever faced? How did you handle it?"

- Where to send complete application: PromiseOne Bank Scholarship Committee Scholarship@promiseone.bank

- Deadline: 10/21/2022

Tips to Protect Yourself from Fake Check Scams

Posted by PromiseOne Bank in News

[6/17/2022] Fake Check Scams As the pandemic continues and as inflation continues to increase, fraud will continue to rise with it. One of the methods fraudster use is known as a fake check scam. In a fake check scam, fraudsters will issue you a check or money order worth more than the amount owed to you and instruct you to wire the excess funds back to them before receiving your lump sum payment. After you have sent the money, you find out that the check or money order is fake. Some scams involve payment for a new job, overpayment for something sold online, or “prize money” from a lottery or sweepstakes that you have “won”. Regardless of the situation, the scammer’s goal is always the same, try to convince you to deposit the fraudulent check or money order and then send some of the money back. Real life scenario: A fraudster emailed the victim saying he found her resume online and after an “interview” conducted over a texting platform, she was “hired”. The new boss needed her to buy a computer and told her he was going to send her a check for $1,900. The victim thought this was legitimate and deposited the check into her account. The money showed up in her account with no problem (so she thought). The boss then instructed her to send payment to an individual via Zelle for payment of the new computer. The victim knew the money was gone, but assumed it was their money to lose and did not suspect any foul play. What she did not realize was the money was never really there. The job was fake, the check was worthless, and ultimately bounced, leaving the victim overdrawn and liable for the amount overdrawn. Federal law requires financial institutions to make some portion of the check funds available immediately (Regulation CC), even before the check clears. However that does not mean that the check cannot come back and reverse. This is why you should be careful when depositing checks from individuals unknown to you. How to protect yourself: If you are suspicious about a check you received, ask yourself:

- Is the check for more than you expected?

- Did you receive specific instructions on how to deposit the check?

- Are you asked to send money back using an immediate form of payment such as, a money order, gift card, wire transfer, or mobile payment?

- Are you directed to act quickly to make the deposit and return the money?

- Does the person who sent the check keep asking when you’re going to send the money?